The Big Picture

What Holds You Back

Hidden inflation eating away margins

High fees from credit cards & payment processors

Settlement delays (days, chargebacks)

Dependance on banks/intermediaries

The Bitcoin Advantage

Instant and final settlements. (no chargebacks)

Low fees payments. (0.1% or lower)

Global reach. (accept payments from anyone, anywhere)

Inflation-resistant asset. (store value securely)

Uncensorable payments. (no one can stop your business from transacting)

Use Cases

Retail — fast & low fees Lightning payments at checkout

Online shops — reduce card fees and fraud

International services — borderless, instant settlements

Treasury — hedge against inflation with Bitcoin holdings

Social Proof & Adoption

(2014) Microsoft accepts Bitcoin for online store and Xbox credits.

(2021) Tesla holds Bitcoin on its balance sheet.

(2020) MicroStrategy used Bitcoin as its primary reserve asset ~ US$ 70 billion.

(2020) PayPal & CashApp allow users to buy, sell and spend Bitcoin.

(2013) Shopify allows neat Bitcoin payment integration.

Book a Consultation

Upgrade to the Bitcoin Standard — book your free 30 min strategy call.

1. We’ll lay out your strategic needs together

2. We’ll clarify how you can leverage Bitcoin securely and stay compliant

3. You’ll get a tailored roadmap after the call

4. You’ll be ready to move forward with clarity

The Data

Wealth Preservation

The purchasing power of your money is being divided by 2 every 10 years at ~10% inflation. This is the hidden cost of saving in fiat.

During the last 10 years, Bitcoin has appreciated by more than 60% per year on average.

MicroStrategy’s model expects a 30% CAGR over the next 20 years.

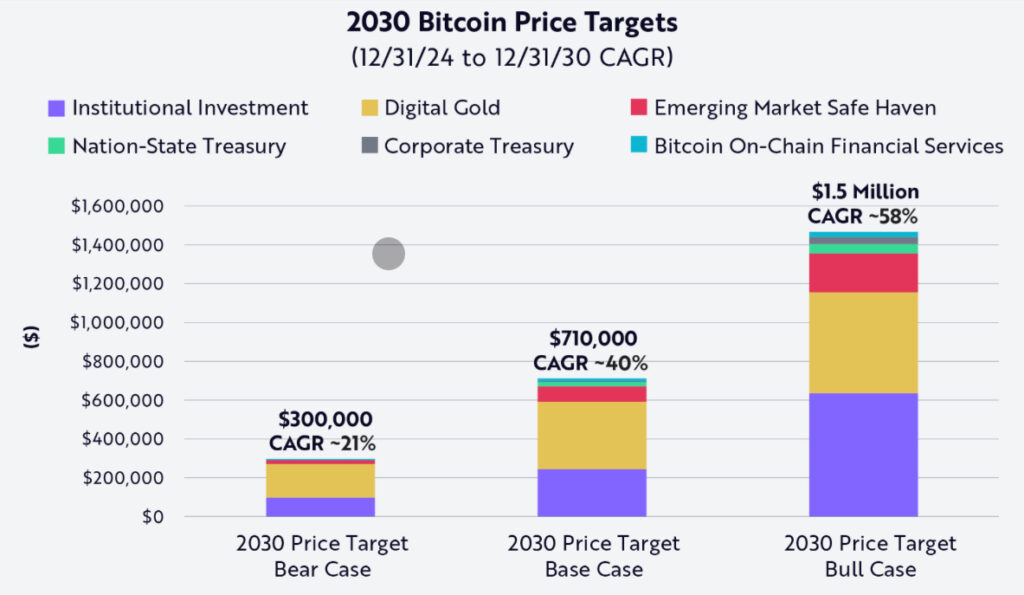

Ark Invest report anticipates a 21% to 58% CAGR until 2030.

Sovereignty

Bank dependence = fragility. Most businesses rely on banks and payment processors that can freeze, deny, or reverse transactions.

Banks (Canada, 2022) were ordered to freeze accounts of people protesting against oppression, totaling C$7.8 million.

Centralized payment providers will block your accounts if you don't comply with this or that. No one can censor you out of Bitcoin.

Fees

Merchants pay 1.5% – 3.5% per transaction depending on card type, country, and merchant category.

Cross-border payments: International remittances average ~6.2% fee globally.

Lightning Network fees are 1,000x cheaper than Visa and Mastercard.

For a modest transaction (say $100), fees under Lightning are likely to be a few cents or less, compared to traditional card fees of $1.50–$3.50 for the same amount.

Settlements

In traditional finance, basic transaction settlements can take days and credit card transactions are reversible for months (chargebacks up to 180 days)

Bank wires can sometimes be clawed back, or held pending compliance checks. That does not exist in Bitcoin.

Reach

Bitcoin opens access to anyone with a smartphone + internet, no matter where they are

BTC Map shows ~18,000 merchants worldwide listed as of August 2025, with thousands of new listings every month.

Estimates put Bitcoin users/holders around 600+ million worldwide in 2025, up from ~400 million in 2023.

Book a Consultation

Upgrade to the Bitcoin Standard — book your free 30 min strategy call.

1. We’ll lay out your strategic needs together

2. We’ll clarify how you can leverage Bitcoin securely and stay compliant

3. You’ll get a tailored roadmap after the call

4. You’ll be ready to move forward with clarity